Sustainability

At Gatehouse Bank we believe in a financial system that is fair for everyone. This fairness extends to the environmental and social structures that support the communities we serve.

It is clear the world we live in today is facing significant challenges. We recognise the banking sector has a crucial role to play in helping to solve many of these challenges for a sustainable future.

We’re taking time to understand the way our business impacts the UK’s most pressing environmental and social needs, like climate change, biodiversity and inequality with an intent to finding opportunities to help meet these needs through our business strategy, products and services. We aim to develop positive solutions that demonstrate we can be a successful business that meets our customers growing expectations, while supporting a better future for all.

Product Innovation

Our products and services are designed according to a set of principles, derived from Islamic teachings, which promote fair play and exclude funding of activities that have the potential to cause harm to society, including highly speculative financial products, the arms industry, and gambling.

We know that our products and services can go even further to make a positive difference and so we are looking at ways we can develop new products and criteria to help you give back to your community and promote sustainable choices.

Did you know the UK is one of the countries in Europe with the lowest amount of woodland? Our award-winning range of Woodland Saver Accounts are designed to support biodiversity and deforestation through tree planting to expand UK woodlands.

Tree planting is vital for meeting some of the UK’s greatest environmental needs. Trees sequester carbon as they grow, filter the air of pollution, provide homes for wildlife, and stop fragile soils from washing away during floods and heavy rain. Tree cover in the UK is increasing but not fast enough – according to the Woodland Trust, woodland creation in the UK needs to speed up by 4x, with a focus on more native species, if we are to tackle the impacts of climate change and give nature a chance to recover.

For every Woodland Saver account opened or renewed, we plant a native UK species tree in a UK woodland. The woodland projects supported by our Woodland Saver scheme are certified by the UK government’s Woodland Carbon Code. The Code delivers externally verified projects, certified by UKAS accredited bodies to ISO standards, that offer tangible social and environmental benefits, including registered carbon credits. It is the only standard of its kind in the UK.

Find out more about our Woodland Saver tree planting scheme here.

Climate Change

Greenhouse gases, the most common of which is carbon dioxide (CO2), trap heat in the atmosphere and warm the Earth’s climate, causing climate change. Severe changes to the climate will impact the economy, environment, and society in various ways, from physical risks like more floods and droughts to changes in policy and technology.

Gatehouse Bank considers how these risks impact our business investments while doing our bit to reduce greenhouse gas emissions. We are focused on ways to cut the amount of energy we use in our own operations and looking at the emissions created by customers accessing our products and services too.

We're a certified carbon neutral business

We have remained a carbon neutral business since 2021.

The Bank publishes an annual emission disclosure reports. In compiling this information, Gatehouse Bank has used Streamlined Energy and Carbon Reporting (SECR). Greenhouse Gas emissions are reported as a single total by converting them to the equivalent amount of carbon dioxide using the emission factor from the SECR conversion factor.

Read our 2024 Streamlined Energy and Carbon Report

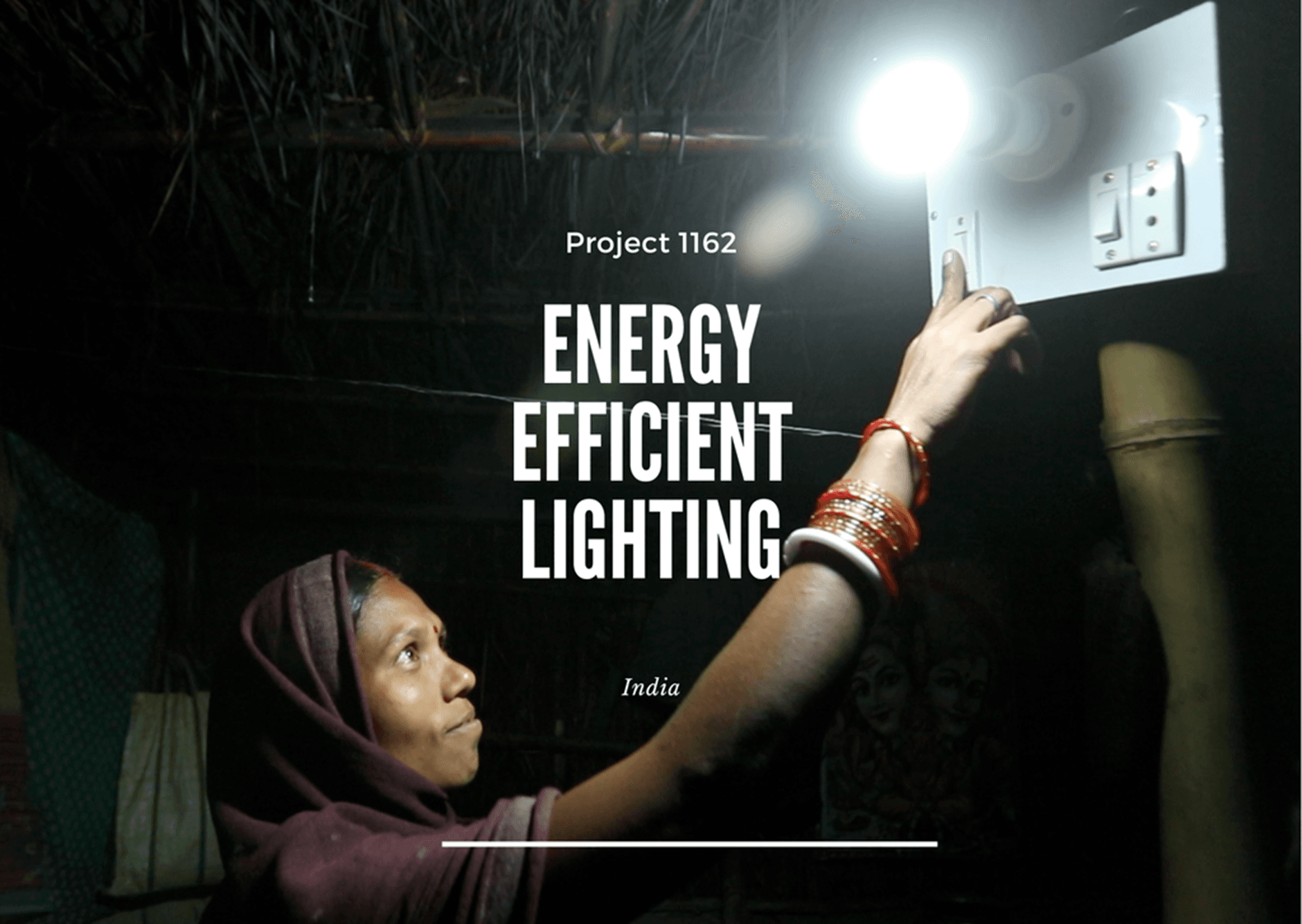

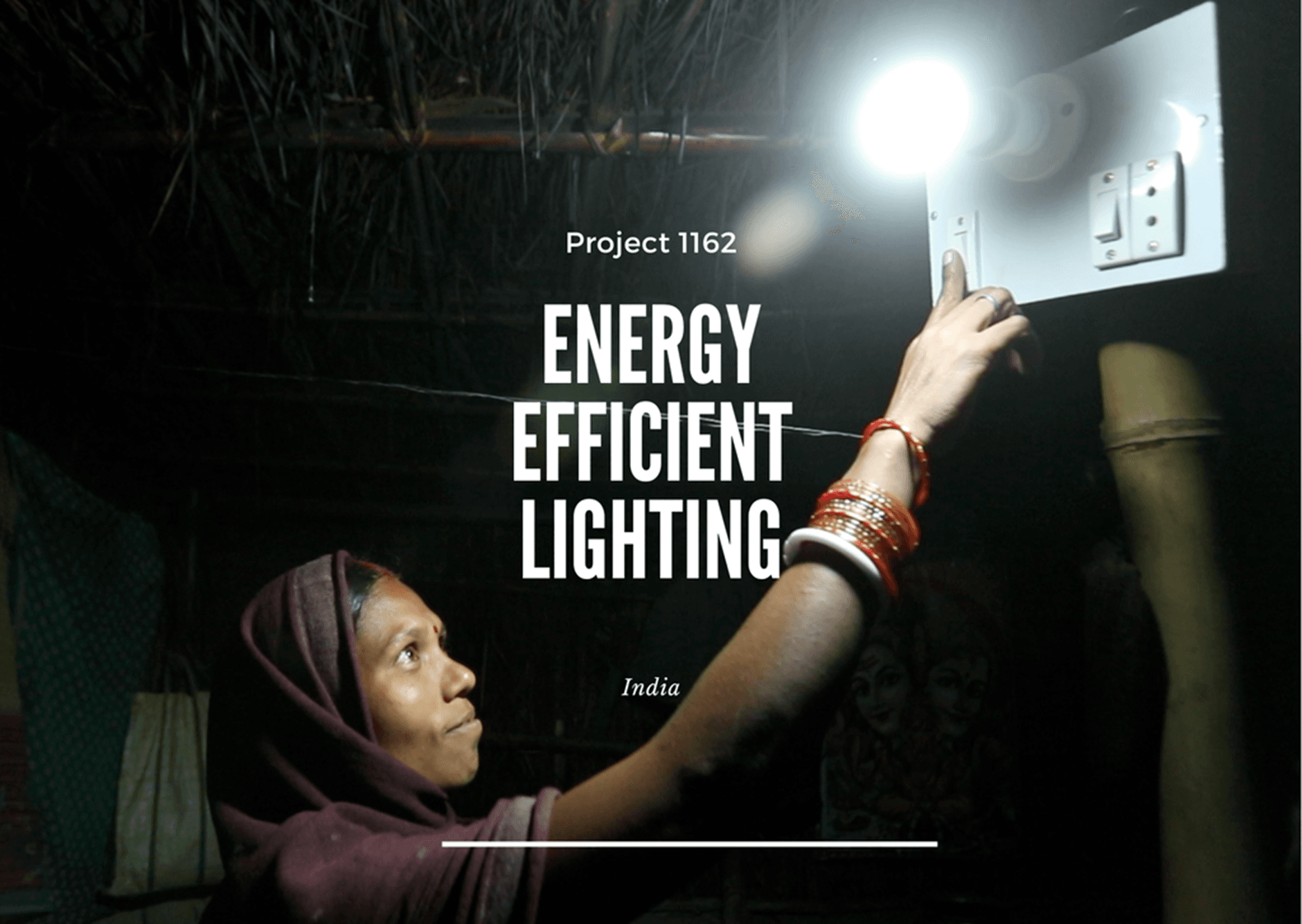

Through our partner Carbon Neutral Britain™, we have offset our annual emissions since 2022 through the Climate Fund™ Portfolio of verified carbon offsetting projects around the world, which are selected based on their direct and indirect global impact. These projects have been certified to the highest standards via the Verra – Verified Carbon Standard, the Gold Standard – Voluntary Emissions Reductions (VER), or the United Nations – Certified Emission Reductions (CERs) programmes.

For more information on the specific Climate fund projects our emissions are offset though, please visit the Carbon Neutral Britain website here.

The Bank offset its total carbon emissions through the Carbon Neutral Britain Climate Fund.

Our approach to climate risk

We take a strategic and governed approach to managing risks due to climate change, in line with regulatory requirements and our internal Risk Management Framework. We ensure the risks arising from climate change are identified, assessed, and monitored adequately and that consideration of climate risk is embedded throughout our organisation.

The UN Sustainable Development Goals

The UN Sustainable Development Goals provide an aspiration for an improved world and a plan for how to get there. Fulfilling this aspiration will take collective effort by all sectors of society, and the financial industry has an important role to play in this.

By taking international frameworks like the UN Sustainable Development Goals into account as we deliver our business strategy, we can help advance these important goals.

Gatehouse Bank is one of the founding signatories to the UN Principles for Responsible Banking, which were launched in September 2019. The UN Principles provide the framework for a sustainable banking system and help the financial sector demonstrate how it makes a positive contribution to society.

As a founding signatory, we have committed to further aligning our business strategy with ESG goals, as expressed in the United Nations Sustainable Development Goals, the Paris Climate Agreement and other relevant frameworks that identify the most pressing societal, environmental and economic needs of our time.

We’ve promised to be honest and clear about how our products and services create value for our investors, customers, and society. We have committed to monitoring our performance and publishing regular and transparent reports to remain accountable.

Our Sustainability Report 2024

You can read all our Sustainability reports on our Corporate Governance page.

“We are proud to be the only UK Shariah-compliant Bank to become a founding signatory of the UNEP FI Principles for Responsible Banking. Gatehouse Bank is a growing force in UK banking and is committed to having a positive impact on the communities we serve. The Principles for Responsible Banking fit with the Bank’s sustainable approach to finance and more importantly, will enable us to continuously review and develop our approach as a responsible provider” - Charles Haresnape, CEO at Gatehouse Bank